Overwhelmed to Organized: A New Nonprofit Founder's Guide (Part 2)

"Start right. If you keep doing what was started right, it will result in a right ending." - Zain Hashmi

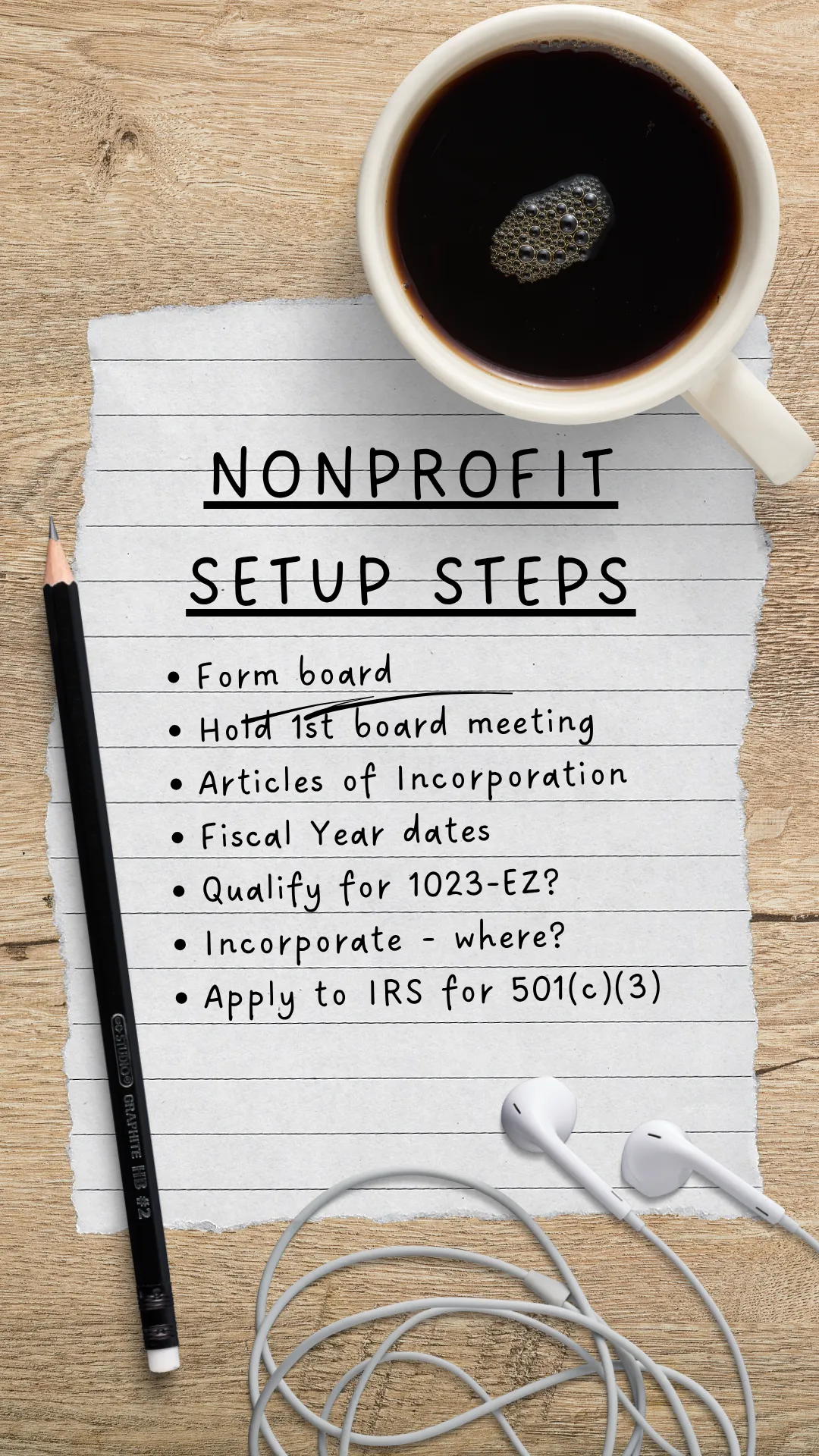

Part 2: Setup Steps (and Missteps) – A Clearer Path to Starting Right

Starting a nonprofit is exciting—but it’s also a legal process. If you skip or rush the early steps, you risk making costly mistakes that will slow you down later or even jeopardize your ability to get 501(c)(3) status.

In Part 1, we talked about that overwhelmed feeling at the beginning. In this issue, we’re building structure around your vision so you can move forward with clarity and confidence.

Let’s walk through the essential setup steps that every founder needs to understand.

✅ 1. You need a board - and the board legally runs the organization.

One of the biggest misunderstandings I see from new founders is assuming they will be in charge of the nonprofit. The truth is:

🧠 The board is the governing body.

🙋♀️ You may be the visionary and day-to-day driver, but legally, the board holds the final say.

Choose your board carefully. Look for people who believe in the mission, are willing to contribute time and insight, and who understand they’re not just figureheads - they’re decision-makers with fiduciary duties.

✅ 2. Articles of Incorporation: What they are and why they matter

Think of your Articles of Incorporation as your nonprofit’s official birth certificate. They are filed with your state to create your corporation. This is step one before applying for tax-exempt status with the IRS.

⚠️ Many founders don’t realize that certain language must be included in these articles to qualify for 501(c)(3) status, particularly around your mission and what happens to your assets if the nonprofit dissolves.

Miss this? The IRS will reject your application, and you’ll have to refile.

✅ 3. Choose your fiscal year

You’ll be asked this on your IRS application. Many nonprofits choose a fiscal year that matches the calendar year (Jan 1–Dec 31), but that’s not required. Many I have worked with have a July 1-June 30 fiscal year. If your program or funding cycles line up better with a different timeline (e.g., a school-year calendar), you can choose that instead.

This is a small but foundational decision. Make it intentionally. It will determine when your tax filings are due, when you prepare your annual report, and when you wrap up your annual giving campaign.

✅ 4. What kind of nonprofit are you forming?

Most charitable organizations apply as 501(c)(3) organizations, which allows you to accept tax-deductible donations. But there are 29 different 501(c) categories.

Here are some common examples:

501(c)(3): Charitable, religious, or educational

501(c)(4): Social welfare (can lobby more)

501(c)(6): Business leagues and chambers of commerce

Know your purpose, and make sure your mission aligns with the category you're applying under.

✅ 5. Do you qualify for Form 1023-EZ?

The Form 1023-EZ is a simplified version of the full IRS application, and it’s a wonderful option if you qualify. The longer 1023 Form is much more involved and cumbersome.

You must:

Expect less than $50,000 in revenue annually for the first 3 years

Have total assets under $250,000

Not be a school, hospital, church, or organization with complex activities

Many new nonprofits qualify for this form, which can be completed online and is often approved much faster. But misusing it or skipping necessary documentation can create big problems down the road.

✅ 6. Where should you incorporate?

In most cases, it’s best to incorporate your nonprofit in the state where you will operate.

Why? Because you’ll likely need to register there for fundraising and compliance anyway.

Some people think about incorporating in states like Delaware or Nevada (because for-profits sometimes do), but this often just creates extra steps and costs for nonprofits.

Unless you have a very specific reason to incorporate elsewhere, keep it simple.

🎯 Need help getting these steps right the first time?

This is what I do every day. I’d love to help you avoid unnecessary stress and missteps.

📘 Check out my book:

Nonprofit Setup Simplified – a step-by-step guide written just for founders like you

🤝 Or work with me directly:

I offer done-for-you services and guided support depending on how hands-on (or hands-off) you want to be. Email me at [email protected] for more information.

🧭 Coming up next:

Part 3: Making It Real – Logos, Websites & Launching Your Identity

In the final part of this series, we’ll talk about branding, websites, and what you need (and don’t need) to look like a legitimate nonprofit from day one.

✨ (Reply or comment—I read every one.)

What part of the setup feels the most confusing or intimidating to you right now?

Email me with any questions: [email protected].